Your AI Trading Copilot

Your judgment, augmented. Your trading, supercharged.

Covering the markets that matter

From Information Overload to Data-Driven Decisions

Quant decisioning built from ML forecasts + context + transparent reasoning.

The Analysis Gap

Manual workflows don't scale with market complexity — more inputs produce more ambiguity, not better decisions.

- Dozens of indicators across multiple timeframes — often conflicting

- Market sentiment shifting faster than manual research can track

- Multi-horizon price patterns appear simultaneously

- Cognitive load from holding all variables while acting under time pressure

Edge comes from consistent synthesis: resolving conflicts, reducing noise, and preserving decision quality under time pressure.

The Analysis Gap

Manual workflows don't scale with market complexity — more inputs produce more ambiguity, not better decisions.

Edge comes from consistent synthesis: resolving conflicts, reducing noise, and preserving decision quality under time pressure.

- Dozens of indicators across multiple timeframes — often conflicting

- Market sentiment shifting faster than manual research can track

- Multi-horizon price patterns appear simultaneously

- Cognitive load from holding all variables while acting under time pressure

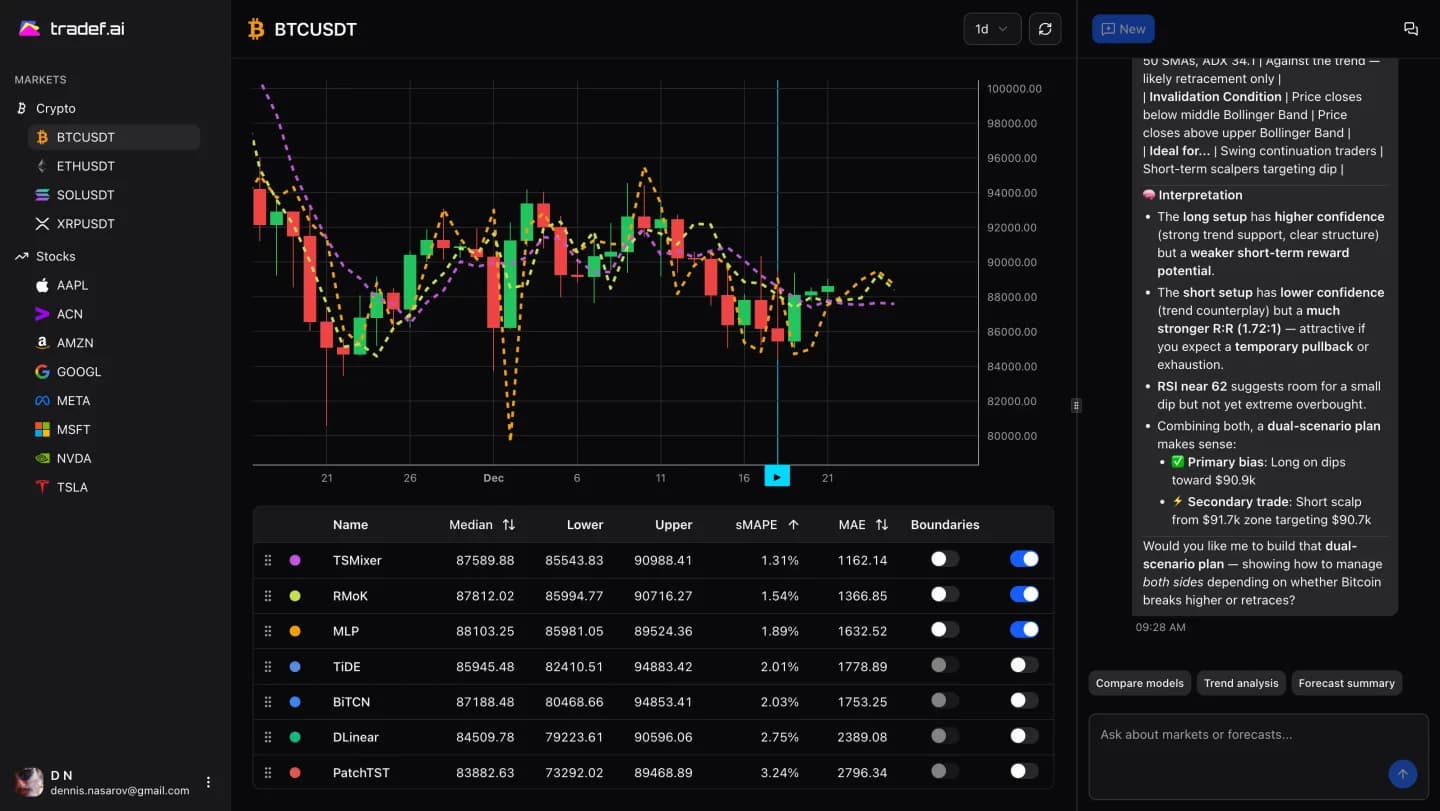

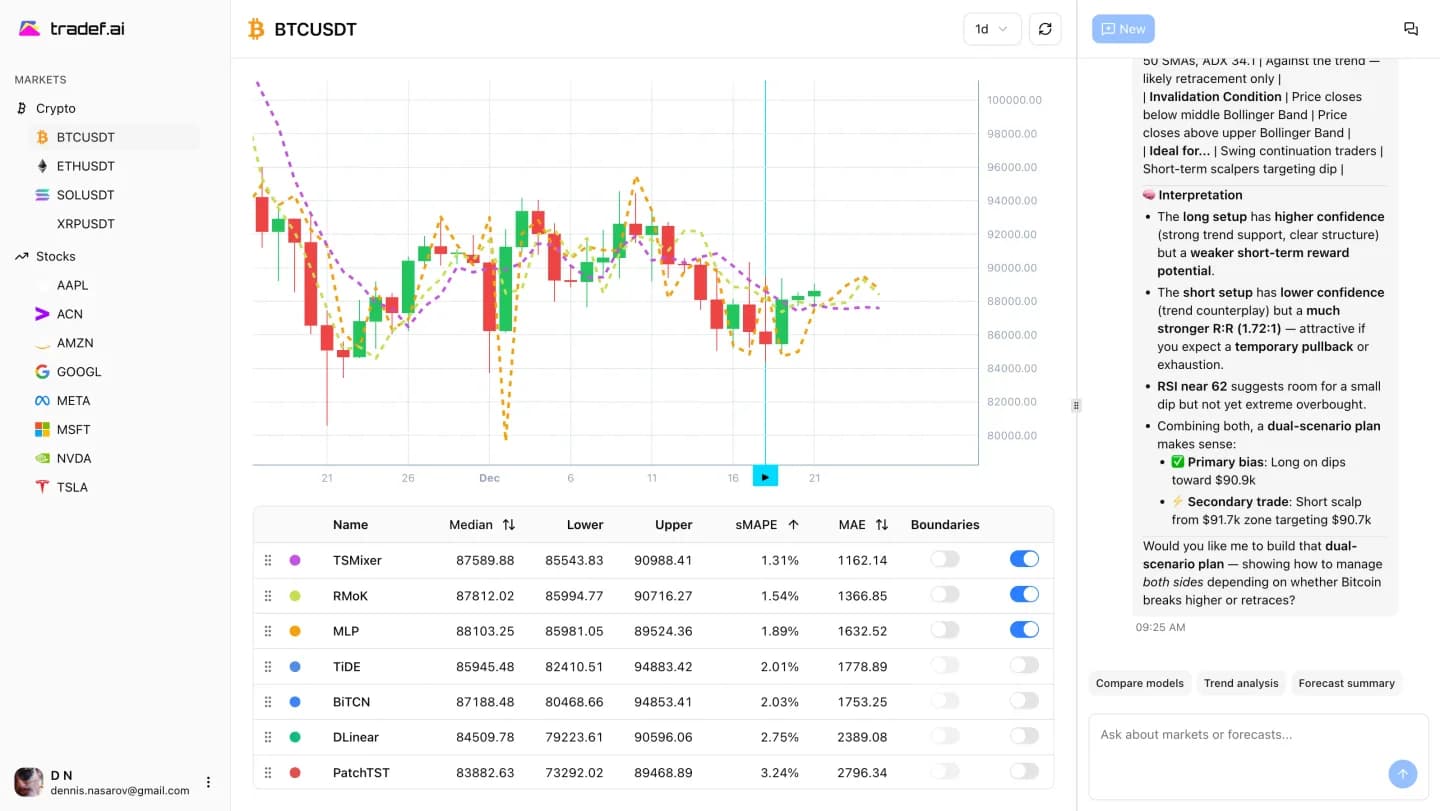

Machine-Learning Forecasting

Quant-grade price predictions powered by an ensemble of production deep learning models

Ensemble Model Architecture

Specialized neural networks trained to recognize distinct market patterns—trend-followers, mean-reversion detectors, and volatility models working in concert for superior predictions.

Automated Hyperparameter Optimization

Bayesian optimization tunes every model, exploring thousands of configurations to find optimal settings for each symbol-timeframe combination.

Multi-Window Cross-Validation

Validated across multiple historical windows for consistent performance in varying market conditions—real-world reliability, not cherry-picked backtests.

Continuous Lifecycle Management

Automated monitoring detects accuracy drift. When markets shift, models are flagged and retrained—keeping predictions fresh and accurate.

Production Models

Each model optimized for a specific symbol-timeframe pair. Together, an ensemble capturing the full spectrum of market dynamics.

Symbols

0

Timeframes

0

Architectures

0+

Market Snapshot Engine

Multi-agent LLM* context engineering builds a complete market picture from technicals, fundamentals, and ML forecasts.

*Not a generic chatbot response — a controlled context pipeline that produces a decision-ready market read.

Context pipeline

Engineered inputs, constraints, and rules built specifically for market decisioning

Specialized agents

Technical, fundamental, and ML-forecast reasoning performed in parallel

Controlled reasoning

Bounded roles and data scopes reduce drift and improve consistency

AI Trading Copilot

Ask about your position or idea — get a data-driven market read and trade plan.

Trading Copilot

I'm long BTC from 95,200. My stop is 94,500. Should I hold, reduce, or exit?

Position review for your BTC long:

- Technical: Price holding above 95K support, RSI neutral at 52

- Risk: Stop at 94,500 gives 0.7% downside — acceptable R:R

- Forecasts: 2/3 models predict sideways, 1 bullish

|

Your personal trading advisor that understands context and explains decisions.

Position review

Your current exposure, unrealized risk, and clear invalidation levels for the position

Market snapshot

Directional bias, key support/resistance, momentum state, and sentiment context across timeframes

Trade plan

Actionable entries/exits, stop logic, take-profit structure, and risk management rules tied to the setup

What to watch next

Specific triggers and conditions that confirm, weaken, or invalidate the plan

What's the market direction now?

Is this a good entry right now?

Where are key support and resistance?

How much risk should I take here?

What's the market direction now?

Is this a good entry right now?

Where are key support and resistance?

How much risk should I take here?

What's the market direction now?

Is this a good entry right now?

Where are key support and resistance?

How much risk should I take here?

What's the market direction now?

Is this a good entry right now?

Where are key support and resistance?

How much risk should I take here?

Should I hold or exit this trade?

Where should my stop loss go?

Am I late to this move already?

Should I hold or exit this trade?

Where should my stop loss go?

Am I late to this move already?

Should I hold or exit this trade?

Where should my stop loss go?

Am I late to this move already?

Should I hold or exit this trade?

Where should my stop loss go?

Am I late to this move already?

Built on production-grade infrastructure

Quant Lab

A public validation layer built on top of our Copilot*. Here we publish live decision outputs and execution results under real market conditions — so you can verify the system and follow ongoing experiments transparently.

*Copilot is production-ready. The Quant Lab is a transparent layer for validation and experimentation.

Live Market Watch Feed

Free, read-only alerts from the AI Trading Copilot — for public research and validation.

Analysis You Can Act On

The Copilot continuously monitors market conditions and converts its decision logic into alerts — so the underlying process is visible, trackable, and independently verifiable.

Condition-Based Alerts

Trigger only when setups meet the decision criteria

Real-Time Analysis

Continuous market scanning across assets and timeframes

Risk-Calibrated Levels

Entries, exits, and risk sizing included with each alert

Transparent Context

See what drove the alert and what could change it

Alert Feed

PreviewMarket Watch Execution Validation

Market execution used to validate the Market Watch Feed under real conditions.

This equity curve reflects executed trades generated from the same decision logic published in the feed. Account tied to real market data, run under predefined risk rules. Data sourced from an Alpaca Markets demo account. Open Trade History & Stats.

Next: 2026 live accounts for stocks and crypto trading.

Join the Quant Lab Community

Collaborate on validation and experiments around the Copilot's data-driven outputs.

Join traders and builders validating the Market Watch Feed and execution results. Share observations, run tests, and contribute feedback that improves the system.

Validate in public

Discuss alerts, market regimes, and outcomes over time

Builders welcome

Use the data and outputs to prototype tools and workflows

Direct feedback loop

Report issues, request features, and shape the roadmap

Simple, Transparent Pricing

Start free, upgrade when you're ready. No hidden fees, no surprises.

Free

See what the AI sees — no credit card required

- AI Forecast Engine — price forecasts across multiple timeframes

- Market Snapshot Engine — real-time context aggregated from various quality data sources

- Market Watch Feed — live trading signals with full reasoning

Pro (Early Bird)

Your AI trading Copilot with answers to everything

- Everything in Free, plus:

- Trading Copilot — private conversations with your AI assistant

- On-demand analysis for supported symbols

- Ask why agents made specific decisions

- Validate your trade ideas with AI feedback

Enterprise

Custom AI intelligence for your trading operation

- Everything in Pro, plus:

- Custom Forecast Engine — your symbols, timeframes, and models

- Custom Analysis Agents — agents built for your strategy

- Custom Trading Agents — your own autonomous trading logic

- Direct A2A access

- Direct MCP access

Built for Skeptics, Not Believers

We know you have questions. Here are honest answers.

We avoid marketing "accuracy claims." Instead, we make forecasting performance measurable. For each model and timeframe we track MAE (the typical absolute miss in price) and sMAPE (the typical percent miss). Forecasts are delivered as probability ranges, not single-point certainties, and you can review confidence and error metrics per symbol/timeframe inside the product. For additional validation, we run a public Quant Lab: the system's decision logic is published via the Market Watch Feed, and the same logic is evaluated through live-market execution under predefined risk rules—so you can follow outcomes over time and verify accuracy independently.

No. The Copilot doesn't trade for you. It's built to deliver analysis and trade planning you can review and apply. The Market Watch Feed is a read-only research layer that publishes condition-based alerts for validation—but it's not your personal auto-trader. You stay in control of every trade.

Most signal services deliver a trade call with limited context—often without clear invalidation, risk framing, or a way to verify the logic. tradef.ai is a decision-support Copilot: you ask about your position or idea and receive a data-driven market read + trade plan (levels, entries/exits, invalidation, risk). We also publish a free, read-only Market Watch Feed for research and validation—but the core product is personalized analysis, not a signal drop.

Right now we support a focused set of crypto and U.S. equity symbols, each with multiple timeframes. Crypto: BTC, ETH, SOL, XRP. Stocks: AAPL, ACN, AMZN, GOOGL, META, MSFT, NVDA, TSLA. For every symbol we provide forecasts and analysis across 5m, 1h, 1d, and 1w timeframes. The list is intentionally short because adding a new symbol isn't just a UI toggle—it requires sufficient compute and meeting dataset requirements to train and monitor reliable forecasting models. If you want a symbol added, message us what you trade and which timeframe matters most—we'll use that to prioritize coverage expansion.

ChatGPT is a general model. When market data is incomplete or stale, it can fill gaps with confident-sounding mistakes. tradef.ai grounds every response in a fresh market-data pipeline and a controlled context workflow. You get a data-backed market read, not a convincing guess.

tradef.ai is built for both. If you're newer, the Copilot turns market data into a structured plan (levels, entries/exits, invalidation, risk) and explains it in simple terms. If you're experienced, it speeds up research and provides a systematic cross-check with transparent reasoning—so you can validate your thesis faster.

We retrain based on model drift, not a fixed calendar. After training, we establish a baseline performance window and then continuously monitor forecast quality. When drift is detected—meaning the model's error worsens and its expected behavior no longer matches current market data—we flag the model for retraining.

Stocks data comes from Finance Modeling Prep (FMP), and crypto data comes from Bybit. Data freshness follows the provider's update cadence, so the system's context is tied to the latest available data.

We don't rely on a generic chatbot. The Copilot runs on a controlled context pipeline: agents receive structured market data and curated context within defined scopes, so outputs are grounded in provided inputs rather than invented facts.

The analysis is periodic, not tick-by-tick. The Copilot updates on a 5-minute cadence, using each new 5m interval as the base refresh cycle.

We take privacy seriously. All traffic is protected with bank-grade 256-bit SSL encryption. Authentication is handled via Google sign-in, so we don't store passwords. We only collect what's necessary to run the service and keep access controlled.

You can cancel at any time with no cancellation fees. After cancellation your conversation history is deleted within up to 30 days.